Shared Ownership

Shared Ownership gives first-time buyers and those that do not currently own a home the opportunity to purchase a new home.

What is Shared Ownership?

Shared Ownership is a well-established route into home ownership. The principle behind purchasing a shared ownership property is that instead of buying the entire home outright, you purchase a share in a brand new home and pay a subsidised rent on the remaining share. You will pay mortgage repayments on the share you own and rent on the share you don’t.

The initial share you buy will usually be between 10% and 75% of the full purchase price and is tailored to suit your circumstances, meaning it is not only affordable for you now, but in the future too. If you wish to increase your shares in the future, you can usually buy further shares until you own your home outright, subject to your lease.

Shared ownership is a government backed scheme that has helped thousands of people get onto the property ladder.

It’s ideal for first-time buyers because you’ll have a smaller mortgage, and you won’t have to find a big deposit.

Shared Ownership properties can often be found in private developments as the provision of a certain number of Shared Ownership units will often be required as a part of the planning permission for a development, this can put affordable housing in the heart of some prestigious postcodes.

Read on for more information about Shared Ownership or click on the link to read the government’s shared ownership guidance.

If you are interested in buying a Shared Ownership home with Rooftop, you can view our current and upcoming properties on 'Find a home' page. Our Sales Team is on hand to help, please contact us on 01386 420837 or email sales@rooftopgrouup.org

How does Shared Ownership work?

The primary advantage of the shared ownership scheme is that it makes a property purchase more affordable.

In a typical home purchase, the deposit needs to be based on the full price of the property, often amounting to tens of thousands of pounds. This high upfront cost can be a major hurdle for many prospective buyers.

With shared ownership, you’re only required to pay a deposit on the portion of the property you’re purchasing, significantly reducing the upfront financial commitment.

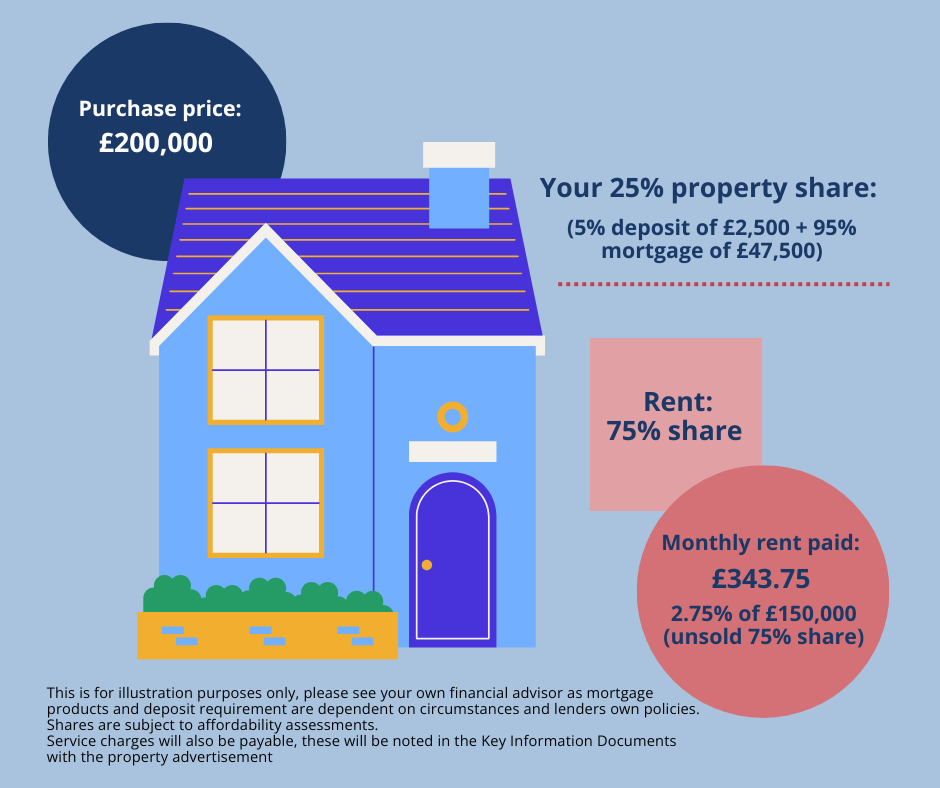

Let’s look at an example.

On a £200,000 home, a buyer might purchase a 25% share at £50,000 with a mortgage and a deposit, typically 5% or 10% on the amount borrowed, which based on a 5% deposit would be £2,500.

Monthly costs would consist of your mortgage payment, rent to the Housing Association on the remaining share and a service charge (as well as other household bills).

Click here to find out how to get financial advice.

Benefits of Shared Ownership

- Your deposit will be lower than if you were buying a home outright as it’s based on the share you’re buying

- You buy a share that’s affordable to you, subject to an affordability assessment

- Designed to keep both the initial and ongoing costs of home ownership manageable and affordable

- Monthly costs usually work out less than renting privately

- More security of tenure compared to renting privately

- A variety of homes may be available from one bedroom apartments, bungalows and large family houses

- Shared Ownership is a government backed scheme that’s helped thousands of people buy their first home

- There is the opportunity to purchase further shares in the property, giving you time and flexibility to save whilst living at the property – a process called ‘Staircasing’.

For your rights and responsibilities as a Shared Owner, read our shared ownership FAQs below.

The new model

The government launched a new model for Shared Ownership in 2021, and the new lease obligations are only for those delivered under the Affordable Homes Programme 2021 – 2026.

Whilst providers continue to deliver homes, there will be a transition period in which both models will be available for some time. Therefore, the model you purchase under will be subject to the development and property you choose to purchase.

Read on for more information about New Shared Ownership Model and please refer to your Sales Consultant to confirm which model you are purchasing under.

Right to Shared Ownership

Right to Shared Ownership allows eligible social housing tenants to purchase their social or affordable rented home on the same basis as a shared ownership property – that is, buying a percentage of the property, and paying a reduced rent on the rest to a housing association.

People exercising the right to shared ownership will receive the same benefits. The Right to Shared Ownership will be available to tenants living in social and affordable rent homes funded by the new affordable homes programme.

More information can be found on the government's website here.

.webp)

.webp)

Increasing your share

The purchaser has the option to increase their share in the property via a process known as ‘staircasing’. If the lease permits, you can eventually buy up to 100% and own your home outright.

Am I eligible?

- You must be at least 18 years old.

- Your combined household income must be less than £80,000.

- You don’t necessarily need to be a first-time buyer, but you can’t own another home at the same time. Your home must be sold subject to contract and sold by the time you exchange contracts on your new home.

- You are unable to buy a suitable home on the open market.

- You must be able to afford the payments for your share.

- You must be able to demonstrate that you have a good credit history.

- You have savings to cover the mortgage deposit plus approximately £3,000 for legal, survey and mortgage fees plus stamp duty (if applicable).

- For some homes you must have a local connection to the relevant area (live, work or family)

What am I buying?

You begin by purchasing part of your home under a lease, and this will either be a new build or resale home. All homes purchased through Shared Ownership are leasehold. You will have a lease, usually this is for 99-990 years but the lease length can vary, especially if the property is a resale.

Shared Ownership doesn’t mean that you have to share your home with anyone else. You are a homeowner and will take on all the responsibilities and gain all of the benefits that go with owning your home.

What's next?

1. Check your eligibility. You can also visit the website below to find out if you are eligible:

Shared ownership homes: buying, improving and selling: How shared ownership works - GOV.UK

Once you have found a property you want to buy, you need to get in touch to find out if you are eligible for Shared Ownership. You can contact us by email sales@rooftopgroup.org or call 01386420837 (Mon – Fri 9am – 5pm).

2. Find a property that is suitable for you

Start your Property Search now.

3. Complete an application form

We will ask you to complete an application form, this allows us to confirm your eligibility for Shared Ownership and register your details with us.

4. Take an affordability Assessment

We will ask you to contact a dedicated mortgage broker who specialises in Shared Ownership mortgages. They will carry out an initial affordability check which will involve working out whether you can manage all the costs of home ownership and some basic criteria questions. They will also determine the share most suitable for you. If rooftop agree we place a soft hold on the property giving you 5 working days to submit your supporting documents, such as copies of your payslips, bank statements and photo ID.

In line with regulative guidance we have to be open in offering our shared ownership homes on a first come first served basis.

Our first come first serve policy at Rooftop Housing Group is based upon:

- Whoever is first to pass their assessment and submit their documents

Our minimum surplus income policy is based upon:

- The minimum amount of surplus income that a customer should have at the end of each month once housing costs, other commitments and expenditure have been accounted for. Our minimum income requirement is 10% of the applicant’s net income.

Find out more about our first come first serve policy and minimum surplus income policy here: Home Ownership Policy

5. Buy the property and appoint a solicitor

Once your documents have been reviewed and signed off in agreeance with Rooftop, an offer letter will be sent for you to agree the sale.

Once the sale has been agreed we will contact you to arrange your reservation appointment and complete your reservation agreement. This will state any special conditions that the purchase involves, discuss the conveyancing process and we will talk you through a reservation checklist which allows us to confirm all particulars of the sale and review any relevant plans with you.

At this stage we will ask you for a non-refundable £250 reservation fee payment and you will be asked to appoint a solicitor to act on your behalf.

If you are buying a ‘resale’ shared ownership property, the sale will need to be agreed by Rooftop and the vendors estate agent.

6. Secure your mortgage

You are now able to apply for a mortgage. At this point you can choose to use your own financial advisor, bank or building society or proceed with our mortgage broker Please ensure the lender you want to use offers Shared Ownership mortgages.

7. The Sales process

Once we have received your reservation fee and signed your reservation agreement, we will issue a reservation document to you and all solicitors involved. This document will summarise the sale and will give a date for when you must exchange contracts.

During the sales process your solicitor will carry out searches, check over the lease and raise any questions they have to our solicitor. Your mortgage lender will need to instruct a valuer to inspect your new home.

Throughout the sales process your appointed Sales Consultant will be available to answer any questions you may have.

8. Exchange of contract

Exchanging contracts means that the buyer and seller are both legally committed to the sale.

Once your solicitor has received all the relevant information from us and they are happy to proceed with the sale, we will exchange contracts and agree a completion date. On the day of completion your money to buy the home will be transferred to us and you will become the leaseholder of the property.

Frequently Asked Questions

Select the category below to see the FAQ's relating to that topic.

Shared Ownership is only available on properties that have been built for that scheme by a housing association using Government subsidy. Therefore, the option does not exist to make an offer on an outright sale property on a Shared Ownership basis.

No. Shared Ownership does not mean you share the ownership of the property, or have to live with another person. It means you own a share of the property and pay rent on the share you don’t own to a housing association. Buying a house with friends, a spouse or a partner is known as joint ownership.

There is no longer a restriction on the number of bedrooms within the property you wish to buy. Previously Shared Ownership purchasers were eligible to apply for properties with up to one extra bedroom than the household size required. Now, as long as you can afford it, you can apply for properties with as many bedrooms as you wish.

Resale properties are homes that a current owner bought through shared ownership and now wishes to sell on. You will typically purchase the existing shared owner’s share of the home, but you are able to purchase additional shares,subject to affordability.

The share you purchase is determined by the affordability assessment carried out and taking into consideration the property price, your income and any monthly outgoings. Generally, our new developments are advertised from 50%, however, some of our shared ownership properties can be purchased from 10% but this can vary by development. Please ask us for further details.

With ‘resale’ properties, the minimum share will be the same share that was purchased previously. So, if the seller had a 70% share in their Shared Ownership property, the minimum share you can purchase will be 70%.

The rent you pay on a Shared Ownership home is often referred to as 'subsidised' or 'discounted' because it's typically lower than the market rent you would pay in the local area.

As a rule of thumb, Shared Ownership rent is set at 2.75% or 3% of the unsold equity i.e. the portion of the property not owned on initial sale. However, the exact rent for each home will be shown on the property listings or price lists.

Your rent will be reviewed every year. Any increases would be based on – and proportionate to – rises in either the Retail Prices Index (RPI) or the Consumer Prices Index (CPI) plus an additional amount, usually between 0.5% and 1%. You can find the rent review provisions within your lease.

Yes, and you can also get help from another scheme called ‘Older People’s Shared Ownership’ if you’re aged 55 or over. It works in the same way as the general Shared Ownership scheme, but you can only buy up to 75% of your home. Once you own 75% you won’t have to pay rent on the remaining share. Further details can be found on the government website: Older Persons Shared Ownership (OPSO) - GOV.UK

The process of purchasing a new-build property depends on a number of factors, such as the length of time required to arrange mortgage financing and the speed at which the solicitors involved can process the sale. Usually it takes around two months from start to finish, however it can take as little as 28 days if everything proceeds quickly. Although, if building work has yet to be completed on the development this may lengthen the process.

The Shared Ownership lease sets out the rights and obligations of both the landlord (i.e.the housing association) and tenant (i.e. the shared owner). The housing association has a contractual right to ensure that the shared owner complies with the terms of the lease. A Shared Ownership lease is where the leaseholder has purchased a share in the property and pays rent on that share retained by the landlord.

Some of the key elements of a Shared Ownership lease contain the following:

- Your rights as a leaseholder

- Rules and regulations contained in your lease

- The conditions of your lease

When a lease term falls below 80 years it is generally considered as ‘short’. Short leases can make it difficult for the leaseholder to sell their home or re-mortgage; as mortgage providers consider it an increased risk against lending on a short lease.

For shared ownership leaseholders, there is no statutory right to a lease extension. However, we offer shared ownership lease extensions through what is referred to as an ‘informal’ route and we will consider any request for a lease extension on an individual basis. This decision falls solely on Rooftop considering eligibility criteria and special circumstances for the extension.

The process of extending your lease normally takes from 3 to 6 months. The cost of a lease extension is determined by a valuer and there will be other costs including but not limited to the premium, solicitors fees, valuation costs and admin fees.

To begin the lease extension process you will first need to request a Lease extension request guide. You can do this by emailing sales@rooftopgroup.org

A service charge is a payment made by the homeowner to the housing association towards the costs of providing and maintaining services for the development you live on. It is applicable on both houses and flats. You must pay your share of these costs as it is a legal duty set out in your lease. The service charge will vary depending on where you live and covers things like:

- Buildings insurance

- Paths and access

- Grounds maintenance

- Communal landscaping

- Sinking funds

- Management fee

The service charge can increase or decrease, and would normally happen at various intervals (usually annually) which will be outlined in the terms of your lease. The amount collected at a development from all residents will be compared with how much has been spent on items such as communal cleaning, gardening and general maintenance and adjusted accordingly. At the end of the financial year, we will clearly explain if there needs to be any changes to your service charge for the year ahead.

Your lease should say how service charges are calculated and how charges are divided between leaseholders.

You can sell your property at any time but you need to tell us. Unless you own the property outright, in line with your lease obligations we usually have the right to nominate a purchaser for a set period of time. If we are unable to find a buyer, you’re free to sell your home on the open market. Some leases require you to offer the property back to us before you sell on the open market. Please check your lease.

The purchase price payable by the new purchaser is based on the open market value of the property. Unless you staircase to 100%, you will only be able to sell the share of the property you currently own. When you sell your shared ownership lease, the new purchaser is agreeing to take on the terms and conditions within the lease.

To commence the 'resales' process we need to obtain an open market valuation of the property and it is a condition of the lease that you pay for this valuation.

Rooftop will advertise the property for sale, and you can advertise with a local estate agent. Once a buyer has been found we will verify eligibility via an application form and refer for an affordability assessment. Any purchaser will be required to acquire the property subject to the covenants contained in your lease.

You will be responsible for any estate agents’ fees and your own legal costs. You will be required to pay an administrative cost for dealing with the sale. This fee is currently £150.00 plus VAT. You will also be required to pay reasonable legal costs for dealing with the assignment of the lease to the new leaseholder. All fees will be payable on completion via your solicitor and these fees are subject to change.

When you sell your home, you’ll benefit from any increase in the value of the property. But you should be aware that, like any other homeowner, you may also be affected by a fall in value.

Please contact us to request a copy of our Resale Guide.

After your initial purchase you can usually buy further shares in your home. This is known as ‘staircasing’. In some cases, such as in rural areas, you will only be entitled to staircase up to 80% of the value of the property. The process will be carried out in accordance with your lease which you will need to refer to. You are allowed to staircase in tranches, and you will need to refer to your lease for the minimum amount required.

The price you pay for additional shares is based on the full open market value of the property and this may go up and down depending on housing market conditions. The value of your home will be set by an independent RICS surveyor and it is a condition of the lease that you pay for this valuation.

As you increase your share of the ownership in the property, your rental payments will decrease. We will revise your rent to reflect the increased share purchased in your property from the time of staircasing completion. If you are staircasing to 100%, known as 'final staircasing', there are terms in your lease that cover these arrangements.

There will be costs involved including solicitors’ fees and valuation fees and an application form will need to be submitted.

Please contact us to request a copy of our Staircasing Guide.

Most pets are welcome in our shared ownership houses, but we have stricter guidance on pets in apartments, as it is essential to respect the rules and guidelines of the community and be mindful of other residents.

Please speak to your Sales Consultant for more information.

When a new shared ownership property is sold for the first time, it’s usually on a 125 or 990-year lease. However, you must check your lease.

If you’re buying a resale property (i.e. from someone who already owns it), you’ll inherit the remaining years left on the lease. For example, if you have a 125 lease property and the current owner has held the lease for 10 years, you’ll have a 115 year lease. If the lease term is less than 80 years, you might want to consider extending the lease. Please speak to your solicitor to find out what this means for you.

All shared ownership homes are sold on a leasehold basis, whether it is a house, bungalow or apartment. This means that the buyer is given the right to live in the property for a set number of years, but the land itself belongs to the freeholder, which will be the housing developer or housing association.

The lease is a contract between the freeholder (housing developer or housing association) and the leaseholder (the purchaser).

If you have purchased a house with a standard lease, usually the freehold will be transferred to you and the shared ownership lease will end once you buy 100% of the shares. Your lease will confirm these arrangements so please read your lease carefully.

If the property value is lower than the Stamp Duty threshold of £300,000, then you will not need to pay any Stamp Duty when purchasing your home.

You would usually only need to pay SDLT on the share you are buying and not for the full property value. However, as rules and limits on SDLT thresholds are subject to change you should check what the current rules are before going ahead. Please speak to your solicitor to find out more and for an exact calculation on the property you are purchasing.

Further information is available on the government website: Stamp Duty Land Tax: shared ownership property - GOV.UK

It does not include any maintenance or repair of your home, decoration, improvements, or gardening.

A sinking fund covers the cost of major repairs that may be needed in the future and provides a way to spread the cost of expensive work that may be needed on your building. Depending on your lease and property it could be used to pay towards external roofs, windows, drains and plumbing systems, parking areas, footpaths, redecorating shared areas and so on. A sinking fund is necessary to ensure that the costs of major renewals and replacements are paid equally by all residents.

If you must contribute to a sinking fund, you usually pay this as part of your service charge and you only have to pay into a sinking fund if your lease says you have to.

You may decide to re-mortgage to obtain a better interest rate or when your current deals comes to an end.

You should advise us that you are intending to re-mortgage, and Rooftop must approve the new mortgage to ensure it meets our requirements.

As with every mortgage there will be associated costs. Please contact us to request a copy of our Remortgage Guide.

If you own a shared ownership property we will need to agree to any changes to the person/people named on the shared ownership lease.

If we agree to the change you will also need to instruct a solicitor to register the changes at the land registry.

If you have a mortgage on the property and the person/ people named on the mortgage is/are changing we will also need to agree to these changes.

Please contact us to request a copy of our Transfer of Equity Guide.

The cost of some services that we must provide under your lease are not paid for through the regular service charge. Please speak to us to find out more.

This typically includes work which we are obliged to carry out including resale fees, valuations, assessments, alteration & improvement requests, lease extensions, and any other costs involved in handling all elements of an enquiry or sale.

This document explains the after-sales fees and charges that may apply once you have completed the purchase of a shared ownership home with Rooftop Housing Association.

Reservation fee – This is a £250 fee you will pay to reserve your home. It is non-refundable but when the sales “completes” it will be deducted from the monies due on completion.

Solicitors Fees – A solicitor will be required to carry out the necessary legal work and the fees will vary depending on the solicitor you use. They typically include search fees, land registry fees and other expenses also known as disbursements. Please confirm these fees with your solicitor.

Mortgage Fees – There may be a fee required as part of your mortgage application and valuation. Please refer to your financial advisor or lender for a full breakdown of fees applicable to you.

Mortgage deposit – Your mortgage lender will usually require a deposit. The cost will vary between lender but typically begins at 5% of the share you are purchasing.

Stamp Duty – This is a government tax on buying a home. You should seek the advice of your solicitor who will tell you if the tax applies and how it can be paid.

Other moving costs – Other costs may be incurred throughout the process such as removal costs which can vary. We recommend that you have between £3000 and £5000 available to cover all the fees and costs of moving, including the solicitor and brokers fees.

As long as you can show at least three years of self-employed accounts (SA302's), you should be able to obtain a mortgage (providing your income is sufficient, of course). You should seek independent financial advice about suitable mortgages and about managing the ongoing costs of home ownership if your income varies from year to year.

Yes, if you are looking to purchase a Shared Ownership property in England (with the exception of London) the maximum household income is £80,000. In London, the maximum household income is £90,000 per annum. This is based on the income of all members of the household whether they have joined the application or not.

There is no set minimum income allowance for Shared Ownership. Each property will have its own valuation and the affordability assessment will determine affordability.

If you are able to demonstrate that you can get a mortgage and maintain the payments, you may be able to buy through Shared Ownership. You will have to undergo an affordability assessment to assess this.

Some lenders will allow EU/EEA residents to have a minimum 2 years UK address history. If you are a non-EU/EEA citizen, then lenders will require a full 3 year UK address history.

Some benefits will not be included as income when assessing your affordability, therefore we would refer you for an initial affordability assessment to see whether Shared Ownership is a viable option for you.

In order to buy you will need to be able to take out a mortgage. If your credit history stops you from doing this, then you will not be able to proceed. As part of your affordability assessment a credit report may be requested.

Existing home owners must have sold the property subject to contract, or had their name removed from the mortgage before we can progress an application.

You may be able to obtain a mortgage based on one income, but in that case the lender would only accept one of your names put on the lease.

The total household income must be below £80,000.

You may be able to apply for a mortgage, but you will need to demonstrate that you have a least two years remaining on your visa and have a deposit of 25% of the share or three years remaining on your visa and a deposit of 20% of the share. If you are able to demonstrate that you can get a mortgage and maintain the payments, you may be able to buy through Shared Ownership. You will have to undergo an affordability assessment with our panel mortgage advisor to assess this.

All repairs and maintenance to the home are your responsibility, regardless of the share you own. Most brand new homes come with a one year warranty period for defects and a longer warranty to cover any structural problems caused by poor workmanship.

When you buy a flat, we will generally be responsible for the grounds and communal parts of the building, and you will be responsible for all repairs and maintenance to your own flat. You will pay a service charge which is used to cover the costs of maintenance and decoration to the communal areas.

Shared owners under the ‘new model lease’ will have the benefit of a new 10 year repair warranty. Please refer to detailed guidance published on our website. You can also refer to your lease or contact your Sales Consultant if you are unsure which model has been used.

You are free to decorate your Shared Ownership property as you wish, however, Rooftop will not contribute to decorative improvements. Your Shared Ownership lease should have details about making alterations to the property, e.g. permanent internal, structural changes etc, which may have to be authorised by Rooftop before work commences.

You should check the terms of your lease. You must seek Rooftop's permission in writing before you make any alterations to your property.

A new build property generally has a defects period in which the developer will attend to most faults within the property. This is usually one year from the date the property is built.

Once the defects period has ended, the shared owner is responsible for any subsequent repairs and maintenance costs. Your home is also covered by an NHBC warranty (or equivalent), which covers your home for structural problems for 10 years.

Defects will need to be reported within the defects period.

Please call 01386 420 800

Sublet your home

Shared ownership leases do not allow you to sublet your home. This may also be a condition of your mortgage.

In some cases such as homes affected by building safety issues or in exceptional circumstances, you may be able to sublet for a specified period. We will consider a subletting request where a shared owner;

(a) Is experiencing financial hardship and is unlikely to be able to sell their home or do so without aggravating that financial hardship or burden.

(b) Is asked by an employer to work abroad or away from home temporarily, which is not within commuting distance.

(c) Has experienced a change in family circumstances such as a relationship breakdown or has to move out of their home to care for a relative.

(d) Is suffering from domestic violence, racial or other forms of harassment.

(e) Is serving a prison sentence.

(f) Is over-crowded.

(g) Is a serving member of the armed forces whose tour of duty requires them to serve away from home (Serving members of the British Armed Forces serving overseas or at a base further than 50 miles or 90 minutes travelling time automatically have the right to sublet their shared ownership properties).

Please contact the Sales Team at Rooftop if you wish to discuss further.

Take a lodger

If you intend to take a lodger, you should check with us, but most Shared Ownership leases allow this. Please click this link to the government website containing important information for you to consider prior to taking a lodger (renting out a room).

Please note, the income you will gain from taking a lodger will not be taken into account when assessing your affordability for a property, you must be able to afford to purchase the property and make the monthly costs independently of the income from a lodger.

The cost of the building insurance is covered in your service charge. Buildings insurance covers costs for damage to the structure of the property. It usually covers loss or damage caused by fire, explosion, storms, floods, or earthquakes. See link to further guidance on our website.

You will need to arrange your own contents insurance separately.

It will be expected that you do not undertake in any anti-social behaviour while in the property and keep to the conditions outlined in your lease.

As a shared owner you are responsible for arranging an annual gas safety check by a Gas Safe registered engineer and getting a valid gas safety certificate. You must also ensure when your appliances are fitted by a Gas Safe registered installer, and a valid gas safety certificate is supplied. To find your nearest Gas Safe registered installer, visit the web link (Gas Safe Register - The Official List of Gas Safe Registered Businesses) or call Gas Safe on 0800 408 5500.

What Rooftop means to me

Shared Owner in Pinvin

Shared Owner

.png)